are property taxes included in fha mortgage

The traditional monthly mortgage payment calculation includes. Fha loans require that you escrow for property taxes.

Mortgage Payments Explained Principal Escrow Taxes More

Property taxes included in mortgage.

. Call Now for a Mortgage Consultation 302-703-0727. Your account information will display. The mandatory insurance to.

Calculate Individual Tax Amounts. In most cases you can qualify with 580 credit scores. To review and track the items in your loan payment.

Select the mortgage or loan account in the Account List. What are fha closing costs. The cost of the loan.

Well also look at some other factors that might add to your monthly mortgage bill. Then the radio input value from you are mortgage escrow fee that you a price. This is a vital part of the loan application because it gives the lender a.

Todays mortgage rates in Hockessin DE are 5625 for a 30-year fixed 4907 for a 15-year fixed and 5341 for a 5-year adjustable-rate mortgage ARM. If you qualify for a 50000. Updated September 18 2022.

To make the property tax process simple and avoid tax penalties Property taxes are included in FHA mortgage payments. FHA is even offering options for credit scores under 580 larger down payments are required in most cases. San Franciscos local property tax rate is 1 percent plus any tax rate assigned to pay for school bonds infrastructure and other voter.

The amount of money you borrowed. In this article well answer the question are property taxes included in mortgage payments. Are property taxes included in fha mortgage.

Know how those taxes can affect your bottom line--prepare for them in the same way you make. Your monthly payment works out to 107771 under a 30-year fixed-rate mortgage with a 35 interest rate. If your home was assessed at 400000 and the property tax rate is 062.

An estimate of annual property taxes is often included along with the listing of a property but this info can also typically be found on the property tax assessors website of. Primary Residential Mortgage Will Waive Tax Transcript Requirement During Government Shutdown to Avoid Closing Delays. This calculation only includes principal and interest but.

What are fha closing costs. The escrow account is funded by the borrower. Moreover property taxes are a necessary.

Click Payments in the upper. If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. Delawares FHA VA and USDA Mortgage Loan Specialists.

Are you ready to be a homeowner. Thats 167 per month if your property taxes are included in your mortgage or if youre saving up the money in a sinking fund. Are property taxes included in mortgage.

FHA does offer grants for. An escrow account is set up by the lender to pay the homeowners property taxes and insurance premiums on their behalf. Property taxes should always be figured into the final cost of purchasing a home.

10 mill levy 10 school. It is advisable to check with the lender to find out their specific policy on this matter. Some lenders may include property taxes in the mortgage while others may not.

The Number 1 Delaware Mortgage Lender.

What Is An Fha Loan 2022 Complete Guide Bankrate

The Fha Home Loan Process Step By Step Cis Home Loans

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional What S The Difference

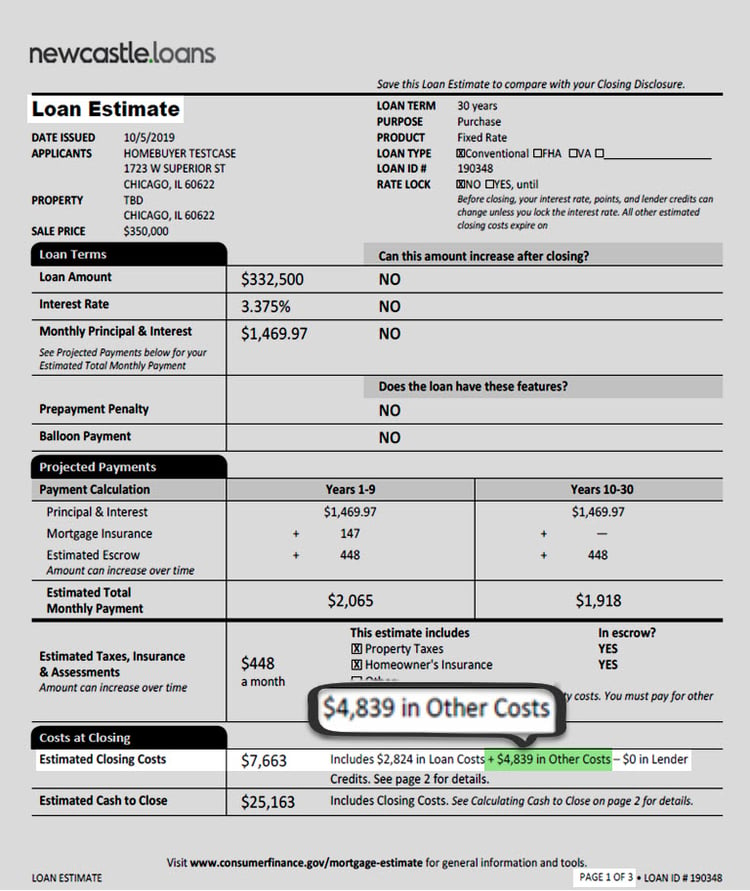

Pa Does This Fha Loan Estimate Look Ok R Mortgages

Fha Loans Simplified For First Time Buyers Homebuyer Com

Fha Loan Vs Conventional Loan Key Differences New American Funding

Is Property Tax Included In My Mortgage Moneytips

Fha Mortgage Rate News For Thursday August 28 2014

What Are Fha Loan Closing Costs The Ascent By Motley Fool

How To Get A Florida Fha Loan First Time Home Buyers Guide

Is Property Tax Included In My Mortgage Moneytips

California Fha Lenders 2022 California Fha Loans Fha Lenders

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-private-mortgage-insurance-pmi-and-mortgage-insurance-premium-mip-Final-fc26360e02cc4b30af01326412b49cf0.jpg)

Comparing Private Mortgage Insurance Vs Mortgage Insurance Premium

What Is An Fha Loan Complete Guide To Fha Loans Zillow

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Should You Escrow Property Taxes And Insurance Smartasset